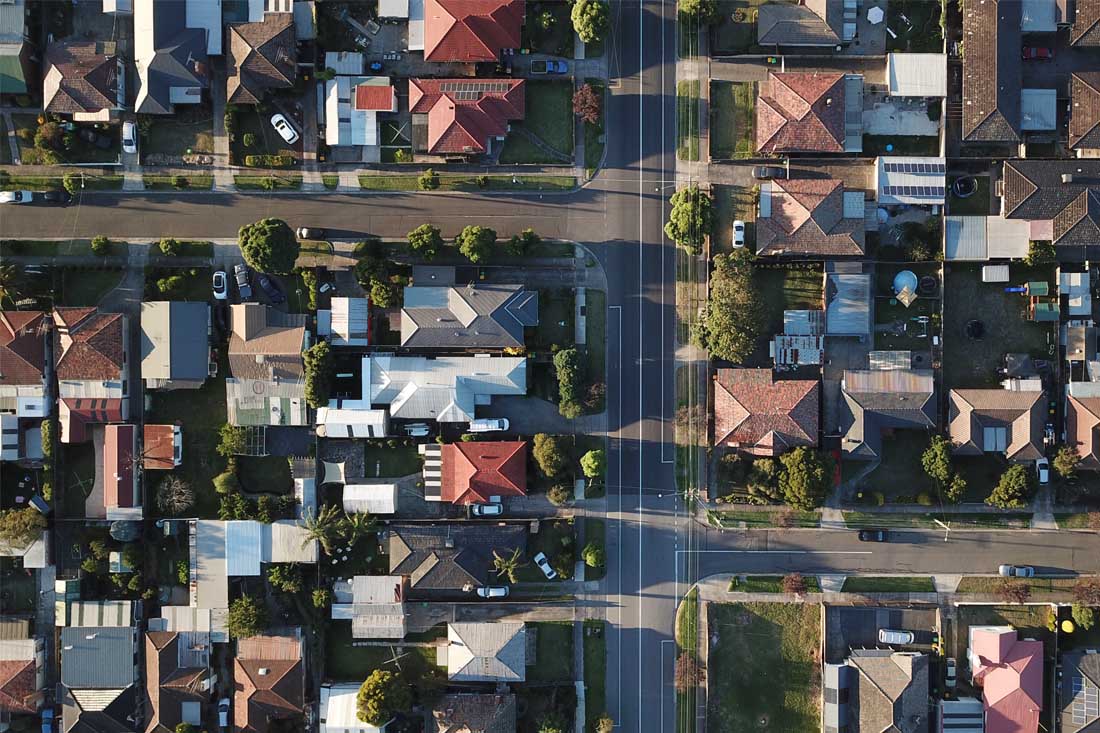

First home buyers charge back into the market

Hats off to Australia’s first home buyers! The latest lending data shows they’re refusing to let last year’s rate hikes and rising property values dampen

Hats off to Australia’s first home buyers! The latest lending data shows they’re refusing to let last year’s rate hikes and rising property values dampen

It’s commonly known that the bigger your deposit, the smaller your home loan, and thus, the lower your monthly repayments. But today we’ll look into

What exactly can a mortgage broker do for you? Well, we don’t mean to toot our own horn, but we can make your home loan

Thought of a New Year’s resolution yet? Or perhaps you’ve broken one already? Either way, check out our list of possible mortgage goals for 2024

The year has flown past, and as our thoughts turn to trees, tinsel and turkey, we’d like to thank all our fantastic clients for your

Home owners have been battling rising interest rates for over a year and a half now. But a new report reveals the important step some

If buying a home is at the top of your wish list for 2024, don’t miss our rundown on how the property market has fared

First home buyers with a small deposit now have an even wider range of lenders to choose from. We reveal the latest banks to join

Introduction: Refinancing a mortgage is a strategic move that can lead to significant financial benefits. In the vibrant real estate market of Sutherland Shire, understanding